- Wealth Stack Weekly

- Posts

- The $2.5T Shift Banks Don’t Want You to Notice

The $2.5T Shift Banks Don’t Want You to Notice

Capital is shifting into private credit and we have a playbook for LPs.

Hi ,

Private credit has ballooned into a $2.5 trillion global market because banks have quietly stepped back. Wells Fargo froze new CRE lending in select markets. Blackstone announced a multi-billion-dollar push into private credit. Most banks are backing away slowly by tightening lending requirements across the board.

None of this made front-page news.

But for investors I talk to every week private credit is top of mind. These folks are paying attention to the momentum of credit’s decentralization:

A full-blown handoff of credit appears underway. Away from banks, and toward capital that moves faster, prices smarter, and lends on its own terms.

This isn’t a trend. It’s the reshaping of how deals get funded—and how portfolios get built.

Over the last 24 months, I’ve shifted nearly $1 million of my own capital into structured credit. Why? Because I want to own the income stream, set the terms, and allocate with clarity.

That’s the strategy more founders and LPs are leaning into every day. As entrepreneurs have migrated from big swing startups to cash flowing businesses, LPs have followed suit and embraced the “equity-like returns with debt-like structure” offering of private credit.

In this week’s issue, we’re unpacking:

How bank pullback created a boom in private credit

Why founders are scaling with debt instead of equity and LPs are building cash flow stacks with structured protection

A case study on equipment financing and the alignment with investor demand

What to look for in "rescue-pref" deals being pitched as yield

Plus, a tactical framework for underwriting real risk, not just projected returns

If you’ve been pitched a credit deal lately—read this issue first.

Let’s dive in—and build the stack that pays you back.

P.S. If you’re looking to get exposure to over-collateralized, cash-flowing private credit–or just want to get smarter about what an offering like this looks like –check out our BuildFlow I fund at Build Wealth here.

SHIFT YOUR STACK

Bank Retrenchment Created a Private Credit Boom And Now Cash Flow Is the New Upside

There’s an incredible shift happening right now. The way capital moves is being permanently reworked. Banks are retreating, making plenty of room for private lenders.

The evidence suggests this isn’t a blip or fad either, but a structural transfer of power from traditional institutions to private capital. And it’s reshaping what smart portfolios look like.

Bank Pullback = Private Opportunity

Tighter regulations. Risk-averse underwriting. Endless delays.

Traditional banks are stepping back across the board—especially from the real economy: small business lending, real estate debt, and middle-market transactions.

Borrowers still need capital. But the banks aren’t biting like they used to.

That’s created an opening. And private credit has stepped into it.

By 2023, private credit AUM surpassed $2 trillion globally, matching the size of the entire high-yield and leveraged loan markets.

In the middle market, it’s now the dominant source of funding—and growing faster than any other asset class.

As rates rose and regulators tightened, banks pulled back. Their risk tolerance has become rather small. Lending standards have now spiked across all categories—pushing borrowers toward private alternatives and tripling over the last decade.

This is where capital formation is happening and returns are being built.

From Passive Curiosity to Engineered Income

Over the last 24 months, I’ve personally invested almost $1 million of my own money into private credit—and I’m increasing that position.

By opening BuildFlow I, we underwrote 9–14% IRRs backed by strong collateral, real control, and aligned operators, which has opened this opportunity to dozens of other LPs. Not to swing for the fences, but to stack reliable, monthly income (or just outperform the market with a collateralized asset).

The idea is to move toward designing your own liquidity and reduce reliance on active income to build wealth.

The Wealth Stack Philosophy Includes Long-Term, Patient Capital

Let’s be clear: We’re not abandoning appreciation.

Many of our deals offer both growth and cash flow.

What we’re doing is staging the portfolio—so that appreciation doesn’t have to carry the full weight of your future.

We use private alternatives to:

Generate consistent, passive cash flow

Reinvest on your terms

Grow both income and equity over time

That’s the game now. Building a portfolio that pays you while it grows.

Liquidity isn’t found. It’s created.

Want to see how we’re positioning around this shift? Click HERE

Explore the data behind the bank pullback, the rise of private credit, and why LP capital is powering the next financial era. Read our full report.

CASE STUDY

Oren Klaff of OK Stone with a large piece of equipment

How Equipment Financing Can Fuel Innovation—Without Giving Up Equity

We’ve been talking about how private credit serves investors. But what about the operators?

OK Stone, a California and Texas-based manufacturer of engineered quartz slabs, is using strategic debt to preserve value, align investments, and bring industrial innovation to market on their own terms.

The Setup: U.S. Manufacturing Meets Modern Materials

OK Stone is building a U.S. facility using Breton’s next-gen Bioquartz tech—a silica-free, ESG-forward material solving major health risks and global supply gaps in the engineered stone market–and a superior product.

Not only is their model filling a niche market but their goal is ambitious. To build a $1 billion company over the next 4 years by launching a state-of-the-art plant to meet surging U.S. demand while creating safer, more sustainable working conditions.

But a facility like this doesn’t get built on vision, passion, and venture funding alone. It requires serious investment in automation, robotics, and advanced machinery—all of it capital-intensive and deeply strategic.

Why Equipment Financing Matters for Businesses and Investors

For companies like OK Stone, equipment financing isn’t just about liquidity—it’s about aligning capital structure with a sustainable business model.

Here’s why it works:

Non-dilutive capital → Our equity investors keep less diluted equity.

Asset-backed terms → Private investors participating in the Equipment Loan get real collateral, 100% advanced depreciation (thanks big, beautiful bill!), and an 8% cash on cash return over 3.5 years.

Flexible repayment → Terms map to production cycles.

This lets operators scale without buying equipment with equity raises. Like all manufacturing companies, they much prefer to use debt for equipment purchases–not equity raises.

Deals like this aren’t just about cash flow—they’re about conviction.

Private credit in this instance is funding execution faster and cheaper than a bank would, while offering investors exposure to potential wins.

Here’s the high level structure on OK Stone’s lease offering:

8% cash-on-cash fixed income stream with 3.5 year payback.

Senior secured loan on state-of-the-art equipment.

A debt position in a company positioned to go public in 2026.

A 0.5% equity “kicker” extra.

and 100% advanced depreciation for maximum tax benefit.

It almost suggests that Equipment Lease Offerings (ELOs) could be emerging as their own sub-set of private credit.

The Takeaway: Debt That Builds

OK Stone shows what happens when smart founders understand financial markets.

When it’s structured right, private credit doesn’t just serve investors. It serves builders.

It’s a great example of how companies “in the know” are likely to copy OK Stone’s innovative approach—and investors “in the know,” win.

Myself and our investors have acquired just over $9 million in OK Stone equity over the last 12 months. However, we are not personally taking out the ELO offering (and I have not done diligence on the ELO like I have the earlier equity investment). If you have interest in the ELO offer above, just hit “reply” to this email with the word STONE, and I’ll make an intro!

BEHIND THE NUMBERS

Private Credit Is the New Operating System for Capital Flow

In the past decade it’s gone from niche to down right necessary.

What used to be a sleepy corner of finance is now where deals get funded—fast, flexible, and structured for how modern capital actually moves.

Global AUM has now surpassed $2.5 trillion, with adoption accelerating across institutions, family offices, and accredited investors. Even the banks themselves are attempting to get involved in private credit lending. Growth isn’t the big story either, it’s the fast maturity and the trajectory to exceed other asset classes.

Private credit now rivals corporate bonds in scale—yet remains under-allocated across most portfolios. As private credit continues to scale, it's not just complementing fixed income, it’s competing with it.

Private Credit Has Evolved Into a Portfolio Strategy

Direct lending was just the beginning.

Today’s credit stack includes a spectrum of yield, duration, risk, and collateral types. When you pay attention you can see they each play a distinct role in the modern private portfolio.

Use this grid to evaluate yield, security, and time horizon. Private credit is no longer a product—it’s a toolkit.

As LPs rebalance away from traditional fixed income, this is where the liquidity and flexibility are being built.

The Line Between Credit and Equity Is Getting Blurred

Some of the hottest “credit” deals right now? They’re not structured to protect principal. Risk without reward is something to look out for.

No cash flow. No collateral. No covenants. Just a glossy deck and a startup offering double-digit coupons.

When capital is priced for credit but exposed to equity risk, LPs are left holding downside risk with none of the reward.

Underwriting still matters. Structure still matters. If you wouldn’t fund it as debt through your own operating company, think twice before adding it to your stack.

Credit Is Powering the Next Industrial Cycle

Private credit isn’t just a “capital markets story,” it’s officially backing the physical economy.

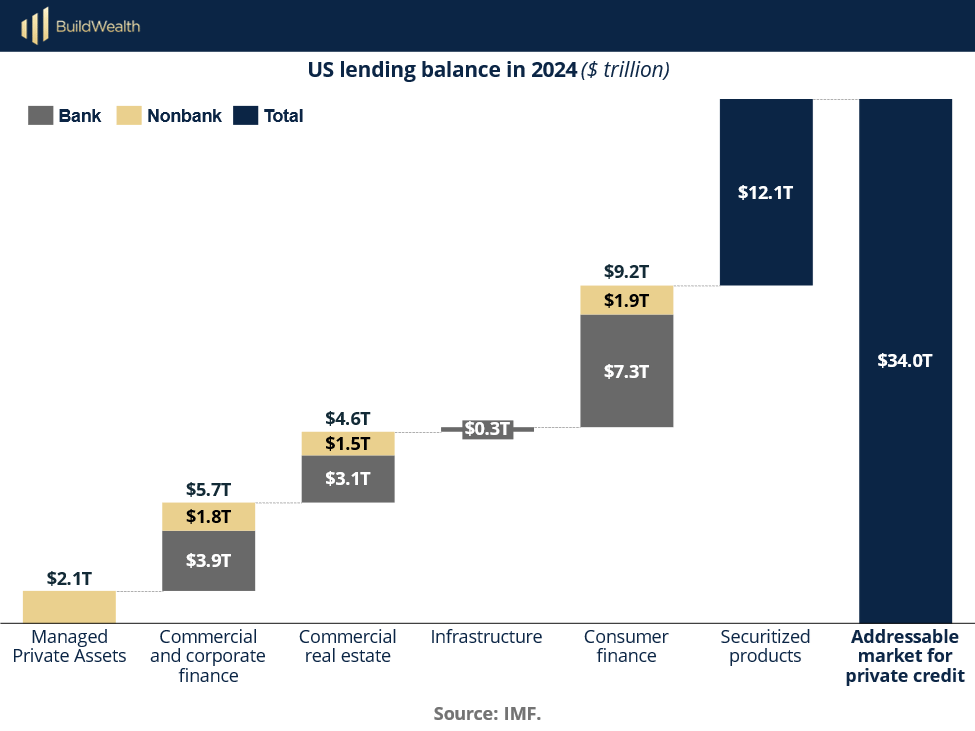

As banks pull back, non-bank lending has scaled across nearly every sector of the real economy.

Here’s what private credit is quietly underwriting:

Equipment-powered manufacturing (e.g., OK Stone)

Energy infrastructure and mineral leasing

Housing development via bridge and DSCR lending

Construction, logistics, and infill growth

These deals aren’t getting done with traditional debt. They’re moving through private capital stacks designed by founders, sponsors, and LPs.

Expect this trend to continue. In 2025, we’ll likely see private credit bifurcate into distinct verticals—energy, real estate, platform-driven, and collateral-backed—each priced and structured for different timelines and risk tolerances.

Bottom Line

Private credit has become a major infrastructure layer of modern private investing.

It fuels scale for founders, recurring income for investors, a better average return than the stock market, and for those who know how to underwrite it well, the clearest path to risk-reward returns in today’s market.

Get familiar with the flavors, because this menu is going mainstream.

THE PLAYBOOK

The Rescue Pref Filter: How to Vet the Quiet Deals Disguised as Private Credit

A wave of opportunistic capital raising is underway. Many of these deals are being marketed as “private credit,” but behave more like structured equity.

Sponsors are filling the gap left by bank retrenchment with creative stacks: equipment lease offerings, preferred equity, and hybrid structures offering yield on the surface—but hiding equity risk underneath. One structure in particular is showing up everywhere right now: Rescue Preferred Equity.

It promises credit-like yield, but often delivers equity-like exposure. And if you don’t understand what you’re holding, you’re not investing—you’re subsidizing.

This isn’t a reason to run. It’s a reason to filter smarter. Here’s a pro rescue-pref deal checker for 2025:

The Rescue Pref Filter: 4 Lenses for Evaluating Hybrid Yield Deals Like a Credit Committee

1. Stack Position: Where Do You Actually Sit?

Start with: “What happens in a fire sale?”

Are you lending into a business—or funding someone else's liquidity crunch?

Are you senior to anyone?

What real collateral backs your position?

Are you behind bank debt or mezz?

Red flag: Rescue pref often lands in the foggy middle—exposed to equity risk, without the upside.

Smart move: Ask for the full capital stack and waterfall, not just your return profile.

2. Control Rights: Can You Act When Things Break?

Being “preferred” means nothing if you can’t pull a lever.

Do you have covenants tied to actual performance triggers?

Step-in rights? Board seats? Veto rights on new debt or dilution?

Can you force distributions, or are you waiting on management’s grace?

Red flag: If you're writing the rescue check but can’t force change, you’re donating—not investing.

Ask: Who’s monitoring compliance, and how is it enforced?

3. Timeline Risk: Are You Trapped in Perpetual Paper?

Yield is irrelevant if liquidity is theoretical.

What’s the real exit plan: refi, sale, recap—or wishful thinking?

Do you get paid quarterly, or only on exit?

Is return back-loaded or front-weighted?

Red flag: “Short duration” with no defined outcome = a long-duration liability.

Ask: What happens if they can’t refi in 24 months?

4. Sponsor Behavior: Who’s Raising What, and Why?

The capital stack is a mirror of intent.

Is this plug-the-gap money? Or fuel-for-scale capital?

Who else is in the deal—and how are they ranked?

What’s the sponsor’s skin in the game?

Are terms tight and transparent—or vague and discretionary?

Red flag: Slides full of optionality and undefined “management discretion.”

Green flag: Sponsors who’ve operated in downturns, co-invest meaningfully, and structure like owners—not storytellers.

Bottom Line

Rescue preferred equity is becoming the quiet engine behind many of 2025’s most marketed “credit” deals.

Some of these are real opportunities. But structure ≠ safety.

To play this right:

Evaluate these deals like stressed-credit—because that’s often what they are.

Underwrite downside first, IRR second.

Push for control, clarity, and collateral—or walk.

In the private markets, structure always outruns story. You either underwrite like an owner—or get diluted like a tourist.

MINDSET SHIFT

Stop Chasing Liquidity. Start Engineering It.

The old model trained us to invest with crossed fingers and 10-year lockups. Hope the market stays up. Hope the exit happens. Hope the fund returns capital before you’re 60.

This issue of WSW flips that mindset.

Private credit isn’t a product—it’s the new architecture of the private markets.

It lets you design your own income, align your stack to your strategy, and move faster than the institutions still anchored to public proxies.

But to unlock this shift, you have to stop thinking like a passive investor—and start thinking like an underwriter.

Take control of your financial journey.

The Wealth Stack mindset doesn’t ask, “What’s the yield?”

It asks: Where do I sit? What’s my control? What happens in a fire sale?

This is how founders scale without dilution.

This is how LPs get income without waiting on public markets.

This is how real investors build portfolios that pay them while they grow.

Look at your portfolio. How much of it is structured for control, cash flow, and clarity?

Welcome to the movement.

Liquidity isn’t found. It’s created.

And we don’t wait—we underwrite.

WHAT WE ARE READING

MASTERING THE ART OF RISK

Walker Deibel (founder of Build Wealth) and Oren Klaff (founder of OK Stone) Discuss Addressing Risk in Deals

Watch their discussion on The Game of Money Podcast #22.

"The banker is a fellow who lends you his umbrella when the sun is shining, but wants it back the minute it begins to rain."

Mark Twain