- Wealth Stack Weekly

- Posts

- Balancing a Portfolio Between Equities and Alternatives: Invest Like the Wealthy

Balancing a Portfolio Between Equities and Alternatives: Invest Like the Wealthy

This report explores the rationale behind this strategy and presents a data-backed approach for retail and institutional investors to emulate the success of the wealthy.

Executive Summary

Wealthy investors, particularly Ultra-High Net-Worth Individuals (UHNWIs) and Family Offices, have long relied on portfolio strategies that extend well beyond the traditional mix of public equities and bonds.

These investors are allocating significant portions of their portfolios to alternative investments, a trend driven by the need for better long-term risk-adjusted returns, capital preservation, and insulation from economic volatility. While public equities remain important due to their liquidity, transparency, and growth potential, wealthy individuals allocate them only as a minority share of their portfolios.

This report explores the rationale behind this strategy and presents a data-backed approach for retail and institutional investors to emulate the success of the wealthy by shifting towards a portfolio with 20 to 25% allocated to public equities and the remainder primarily invested in alternative assets. The objective is to combine liquidity and flexibility with long-term compounding, reduced sensitivity to macroeconomic turbulence, and enhanced portfolio stability.

The Case for Diversifying Beyond Public Equities

The dominance of public equities in retail investor portfolios has persisted due to accessibility, ease of trading, and historical emphasis in traditional financial advice. However, analysis of the asset allocation strategies of UHNWIs reveals a stark contrast. Data clearly illustrates that retail investors allocate approximately 70% of their portfolios to public equities, while UHNWIs allocate only 30%. The remaining 70% is distributed among private equity, real assets, hedge funds, private credit, and other alternative strategies. This significant divergence underscores a strategic difference in risk and return objectives, especially over the long term.

Public equities offer several advantages. Chief among them is liquidity, which provides investors the ability to reallocate capital quickly and meet cash needs when necessary. They also provide access to market transparency and regulatory oversight, which increases investor confidence. Furthermore, equities are historically one of the most effective vehicles for capturing growth, particularly in innovative sectors such as technology and biotech.

Nevertheless, the volatility and sensitivity of public equities to macroeconomic shifts cannot be overlooked. Equities, especially those in indices like the Nasdaq, react strongly to interest rate changes, inflation data, and geopolitical risks. These factors introduce significant short-term risk, which may be manageable for short-term traders but becomes increasingly problematic for long-term wealth preservation.

How the Wealthy Allocate: A Data-Driven View

A deeper look into the allocations of UHNWIs and Family Offices shows a broader and more sophisticated approach to portfolio construction. Family Offices typically allocate a substantial portion to private equity (about 19%), real estate (13%), hedge funds (7%), commodities (2%), and other niche strategies such as art and antiques. Equities still represent an important component, but they are held in moderation. Similarly, High Net-Worth Individuals (HNWIs) tend to invest around 47% in equities, with the remaining portion spread across private companies, real estate equity, bonds, and cash equivalents.

These allocations reflect not only a desire for higher returns but also a conscious effort to manage downside risk and create a more robust portfolio that can weather multiple economic cycles. Alternative investments provide lower correlation to traditional markets and are often less susceptible to daily market swings, making them ideal for long-term wealth accumulation and preservation.

Market Sensitivity to Economic Uncertainty

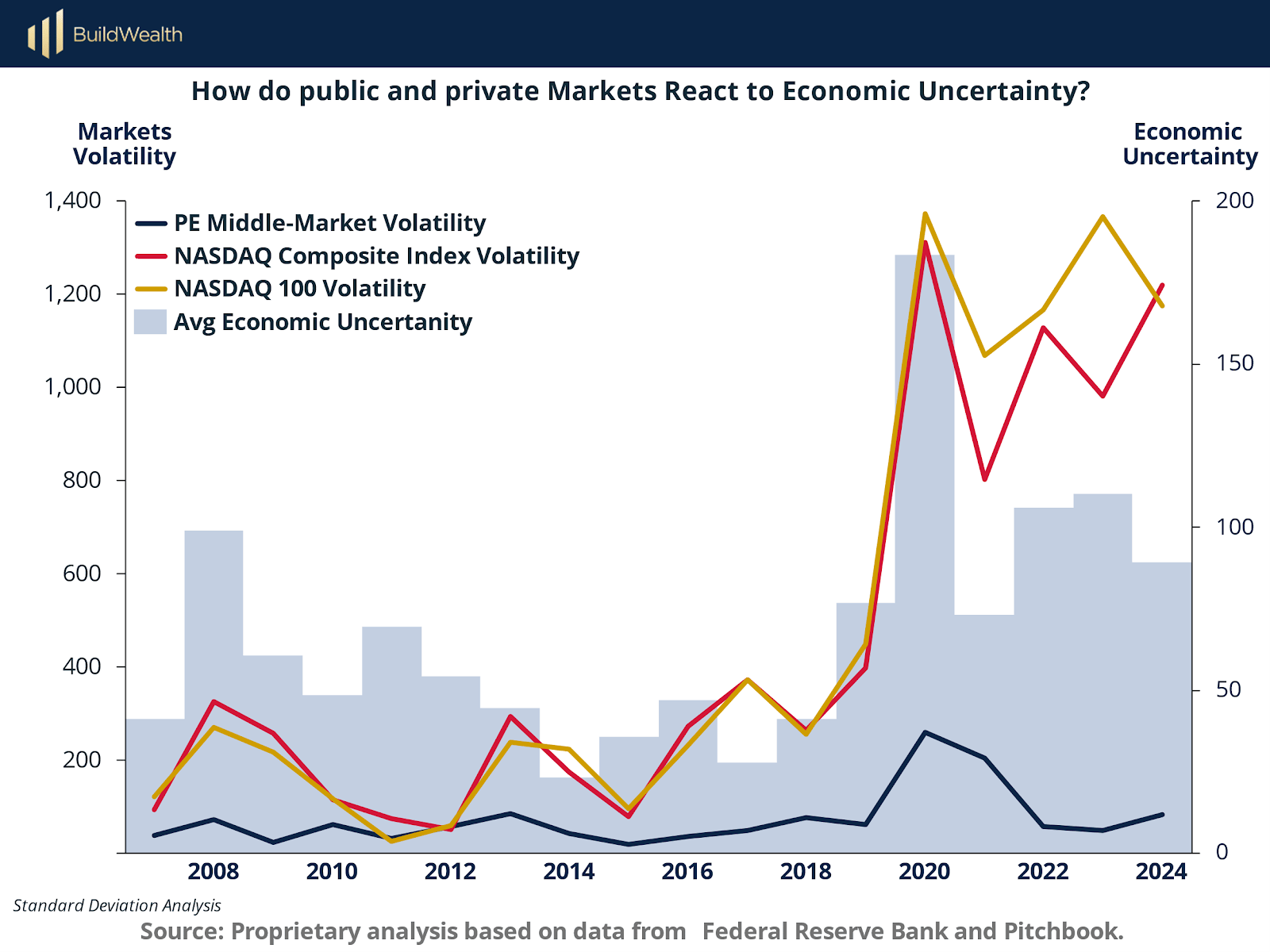

The role of economic uncertainty in asset performance is crucial, particularly for investors with longer time horizons. Public markets, as evidenced by historical data, demonstrate high volatility in response to economic uncertainty. Indices such as the Nasdaq 100 and the Nasdaq Composite Index show marked declines when Treasury yields rise or when macroeconomic forecasts become pessimistic. In contrast, private market investments such as middle-market private equity display greater resilience.

Regression analysis reveals that Nasdaq indices are nearly twice as sensitive to movements in Treasury yields compared to private market benchmarks. This indicates that public markets, while efficient and transparent, are far more exposed to policy and sentiment-driven fluctuations. This is further reinforced by observing how volatility reacts over time.

During major periods of macroeconomic disruption, such as the global financial crisis and the COVID-19 pandemic, public market volatility surged. Nasdaq 100 and Composite Index volatility rose sharply in tandem with the Economic Uncertainty Index. Meanwhile, the volatility of private equity middle-market investments remained relatively stable, highlighting their insulation from daily market shocks and reactive investor behavior.

Further quantitative analysis demonstrates that the standard deviation of volatility in public markets is 3 to 4 times higher than that of private markets when regressed against volatility in the Economic Uncertainty Index. This empirical evidence validates the thesis that private markets offer a more stable return profile, especially in turbulent environments.

The Role of Alternatives in Wealth Creation

Alternative investments span a wide range of strategies including private equity, private credit, infrastructure, real estate, hedge funds, venture capital, and even collectibles such as fine art and classic cars. These assets offer the potential for enhanced returns through access to inefficiencies in private markets, deal structuring advantages, and long-term growth opportunities unavailable in public markets. Additionally, many alternatives serve as hedges against inflation and offer intrinsic value that is less subject to market speculation.

Brookfield Oaktree’s research supports this positioning. In a comprehensive study, they demonstrate that portfolios with higher allocations to alternatives not only outperform traditional 60/40 equity-bond portfolios over time but also deliver significantly lower volatility. Advisors overwhelmingly agree: nearly 80% believe that alternatives position portfolios for outperformance, and more than 85% of surveyed investors see alternatives as essential to a successful long-term investment strategy.

Structuring the Optimal Portfolio: A Model for Investors

The optimal portfolio structure emerging from the data and institutional practice recommends maintaining 20 to 25% in equities for liquidity, optionality, and exposure to innovation and public markets. The remaining 65 to 70% should be diversified across private equity, real assets, private credit, and hedge funds to ensure lower volatility and consistent returns.

Performance metrics reinforce this allocation. A 25% equity allocation combined with 70% in alternatives significantly improves portfolio return (up to 8.5% annualized) while reducing risk below 5% standard deviation. In contrast, portfolios with high equity exposure (e.g., 60% equities) exhibit higher volatility and lower returns.

The following risk-return scatter plot illustrates that as alternative allocations increase, portfolios move toward the optimal frontier, achieving higher returns with less risk. The curve flattens beyond 80% allocation to alternatives, suggesting diminishing incremental gains but still favorable profiles compared to traditional models.

The risk-return scatter plot illustrates that as alternative allocations increase, portfolios move toward the optimal frontier, achieving higher returns with less risk. The curve flattens beyond 80% allocation to alternatives, suggesting diminishing incremental gains but still favorable profiles compared to traditional models.

Implementing the Wealth Stack Portfolio

The Wealth Stack Portfolio embodies these principles by recommending a foundation built on 70 to 75% alternative investments. This allocation supports long-term capital appreciation, provides inflation protection, and diversifies exposure across sectors and geographies. Equities, maintained at approximately 20-25%, allow for nimble reallocation and participation in growth markets. Cash and fixed income provide added security and funding flexibility.

This approach mirrors how UHNWIs and Family Offices operate, focusing on private markets for core compounding while retaining public equities for liquidity and strategic leverage. Investors adopting this structure gain the benefit of reduced drawdowns, improved Sharpe ratios, and long-term wealth sustainability.

Conclusion: Integrating Both Mainstream and Alternative Investing for Long-Term Prosperity

Investing like the wealthy is not about abandoning public equities, it's about balancing them strategically with alternative investments to achieve long-term, resilient wealth. While public equities offer essential benefits—liquidity, market visibility, and growth—over-reliance on them exposes portfolios to heightened volatility and macroeconomic shocks.

By adopting a more inclusive approach that integrates both mainstream (public) and alternative markets, investors can position themselves for improved risk-adjusted returns, portfolio durability, and capital preservation. A diversified model with 20 to 25% allocated to equities and the remaining majority to alternatives reflects how UHNWIs and Family Offices successfully build lasting wealth across market cycles.

This approach is no longer exclusive to institutional or ultra-wealthy investors. As access to private markets expands through new financial vehicles and advisory platforms, accredited investors should strongly consider incorporating alternatives into their portfolios as soon as eligibility allows. Doing so can provide the same compounding advantages, downside protection, and forward-looking stability that define sophisticated investment strategies.

Long-term prosperity lies in embracing diversification, challenging traditional allocation models, and building confidently across both public and private markets.

Sources & References

Balloch, Richers. (2023). LSE, DISCUSSION PAPER NO 885. Asset Allocation and Returns in the Portfolios of Wealthy. https://www.fmg.ac.uk/sites/default/files/2023-08/DP885.pdf

Brooksfield. Oaktree. (2024). Diversifying with Alternatives. https://www.brookfieldoaktree.com/thealtsinstitute/diversifying-alternatives-risk-return-analysis

Cesarone, Giacometti, Martino, Tradella. (2023). A return-diversification approach to portfolio selection. https://arxiv.org/pdf/2312.09707

Fidelity. (2024). Considerations when implementing alternative investments in multi- asset class portfolios. https://institutional.fidelity.com/advisors/insights/topics/investing-ideas/considerations-when-implementing-alternative-investments-in-multi-asset-class-portfolios

JP Morgan Wealth Management. (2025). The potential benefits of alternative investments. https://www.jpmorgan.com/insights/investing/investment-strategy/the-case-for-alternative-investments

PIMCO. Learn About the Role of Alternatives in a Portfolio. https://www.pimco.com/us/en/resources/education/learn-about-the-role-of-alternatives-in-a-portfolio

Professional Wealth Management. (2024). Alternative assets becoming key battleground for wealth managers. https://www.pwmnet.com/content/7122294c-0d2b-563e-87ec-bedb5862bddf

Wealth Enhancement. (2024). America’s Wealthiest Are More Likely to Invest in These Alternative Assets Than Their International Counterparts. https://www.wealthenhancement.com/blog/america-s-wealthiest-are-more-likely-to-invest-in-these-alternative-assets-than

Wrise. (2024). The Role of Alternative Investments in Diversification. https://www.wrise.com/insights/the-role-of-alternative-investments-in-diversification

Premium Perks

Since you are an Wealth Stack Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Visit our website.